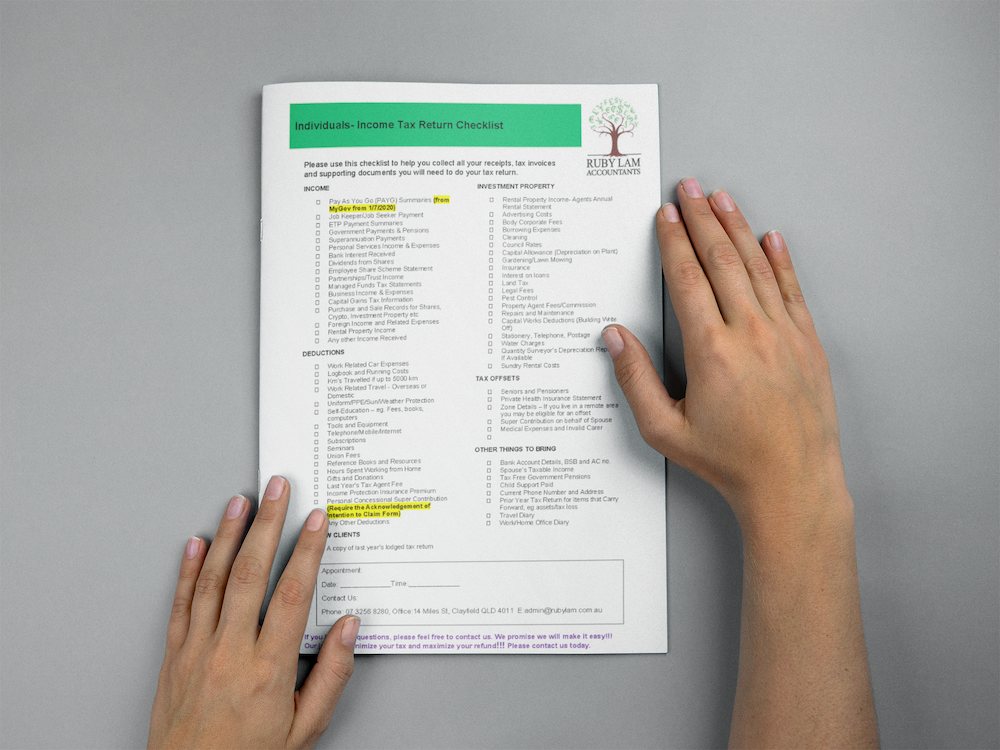

This checklist can be downloaded and used to collect all your receipts, tax invoices and supporting documents, that you will need to do your Tax Return.

Individual Tax Rates that apply to your Taxable Income.

Maximise and Understand YOUR Tax Deductions. When completing your tax return, you’re entitled to claim deductions for some expenses, most of which are directly related to earning your income.

How you apply for a Tax File Number (TFN) will depend on your circumstances.

Tax Tables and calculator to help you calculate correct staff PAYG withholding tax.

Small business entity concessions

Small businesses can access a range of concessions including payment and reporting options. This applies to sole traders, partnerships, companies or trusts.

Useful tips and tricks to find any lost superannuation funds and consolidate your accounts.

Calculates the most tax effective method to contribute to your self managed superannuation fund.

Super Co-Contribution Calculator

Identifies eligibility for the government co-contribution and estimates the amount that should be remitted to the member.

Contact Us

14 Miles Street

Clayfield, QLD 4011

07 3256 8280

admin@rubylam.com.au

Office Hours

Monday – Friday

9.00 am – 5.00 pm

After hours appointments are available on request

Copyright | Website design by Absolute Web Design

Privacy Policy | Contact Us